Individual forms

IRS requests personal (individual) federal income tax returns, such as Form 1040 ("Long Form"), 1040A ("Short Form") and 1040EZ ("Easy Form"), annually. The due date for individual tax returns is April 15 the next year after the reported period. If April 15 falls on Saturday, Sunday or legal holiday, the returns are due the next business day.

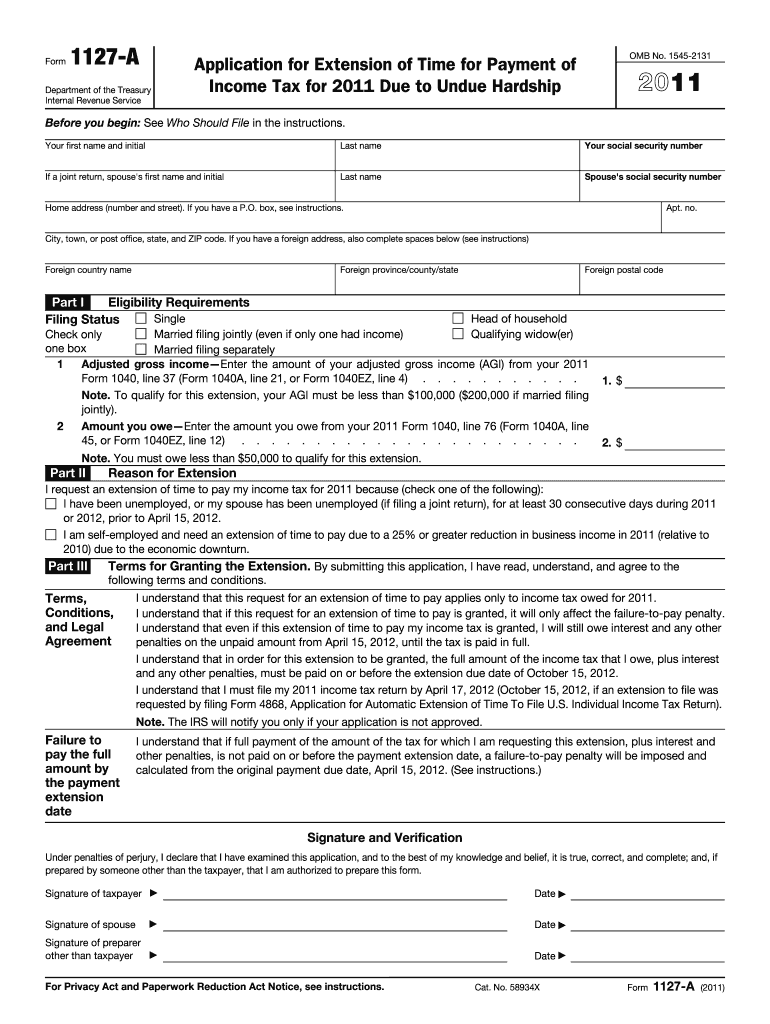

1127-A form

Application for Extension of Time for Payment of Income Tax for 2011 Due to Undue Hardship

Learn more

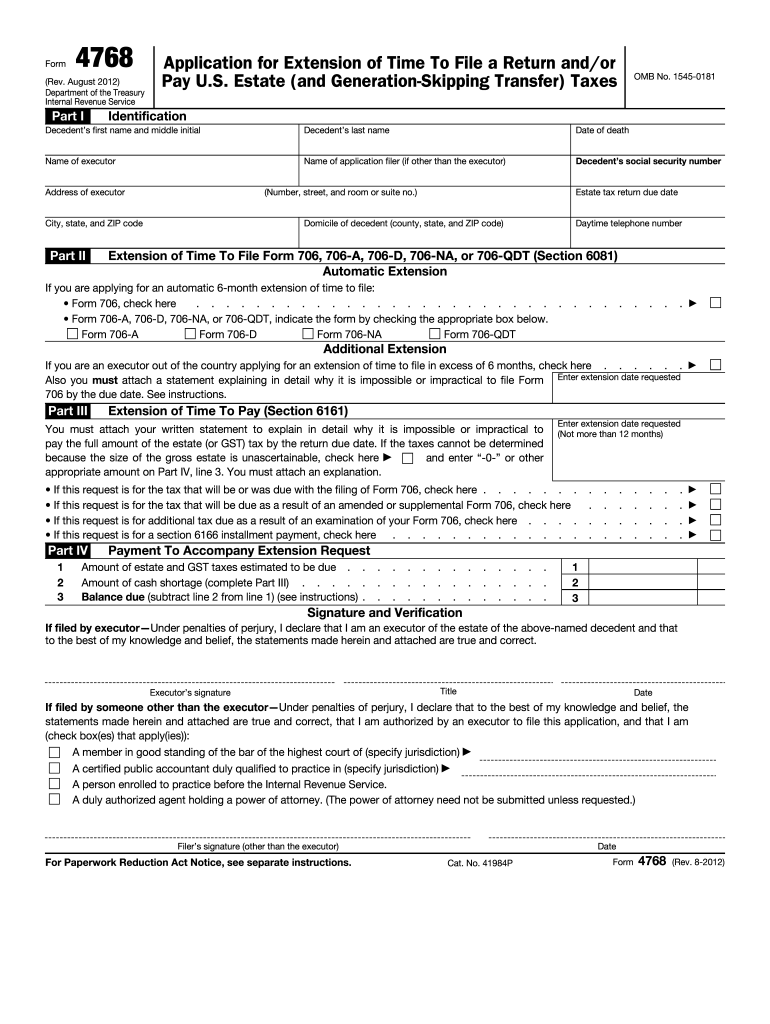

4768 form

Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes

Learn more

8802 form

Application for United States Residency Certification

Learn more